Q&As

Q&As

Q&A info

Θέλετε αναζητήσετε τη σχετική ερώτηση και απάντηση στη γλώσσα σας; Αλλάξτε τη γλώσσα στο αναπτυσσόμενο μενού ανωτέρω.

Επιστροφή

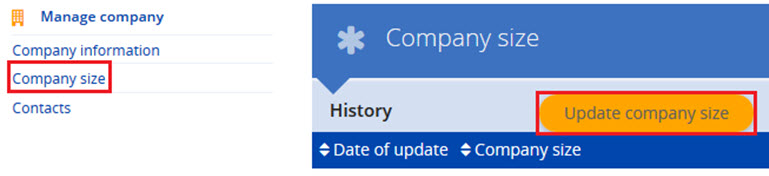

The company size can be updated in REACH-IT via the ‘Company size’ functionality from the main menu and selecting the ‘Update company size’ functionality.

This will open a wizard that will guide you through the process of updating the company size. Read carefully the instructions and have the documentary evidence at hand to substantiate the companies involved in the ownership structure.

Note: By declaring that your company is an SME, you become eligible to an SME fee reduction. ECHA routinely verifies the SME status of legal entities who self-identify as SMEs. We recommend that you keep your company size information up-to-date in your REACH-IT account.

The final decision on what documentation is considered adequate evidence of a ‘sale of assets’ is determined on a ‘case by case' basis in accordance with the relevant national principles of private and corporate law of the Member State where the entity is established. For this reason ECHA Practical Guide 8 – How to report changes in identity of legal entities limits itself to the general example of the asset sales agreement and does not provide further information in this regard.

The relevant documents should be presented to the national enforcement authorities upon request. Ultimately, the REACH duty holders bear responsibility for the submission of adequate documentary evidence. To ensure that it complies with the national legal order they may seek legal advice from in-house or private practice lawyers, for example.

More information on changes in identity of legal entities can be found in the aforementioned Practical Guide 8 – available at http://echa.europa.eu/practical-guides

Transferred items (i.e. registrations/notifications)

If a registration/notification for a substance is transferred from the legal initiator to the legal successor, who already has a valid registration/notification for the same substance, the status of the transferred registration/notification will be marked ‘Annulled’, because a legal entity can only have one registration for the same substance.

Tonnage band update

For transferred registrations when the originating legal entity has registered the same substance as the legal successor and the tonnage of the originating legal entity is higher than the registered substance of the legal successor, the system will keep track of the legal successor's right to a higher tonnage band. The legal successor will need to submit a spontaneous update to indicate the higher tonnage band. No fee applies for this update.

Transfer of joint submission roles linked to Registrations

Where the initiating legal entity has submitted registrations as part of a joint submission, the joint submission role (e.g. Member or Lead registrant) are transferred together with the registrations to the legal successor. If no registrations were submitted, the roles are not transferred. The legal successor need to confirm their membership to the joint submission.

Invoicing

The Agency will issue an invoice for the legal entity change pursuant to Commission Regulation (EC) No 340/2008 Article 5 (Fee regulation) if the item list contains one or more payable items.

- Items that trigger a fee during a legal entity change are: Registrations, Registration of on-site isolated intermediate, Registration of transported isolated intermediate.

- Items that do not trigger a fee during a legal entity change are: Pre-registrations, Product and Process Oriented Research and Development (PPORD) notifications, Classification and Labelling (C&L) notifications, Inquiry notifications.

Where an invoice is needed (i.e. the legal entity change includes at least one payable item), only one invoice will be issued per legal entity change. Invoices are issued to the legal successor. The company size of the legal successor after the change of legal personality will determine the fee. Pursuant to Commission Regulation (EC) No 340/2008 Annex III Table 3, a reduced fee will be invoiced to SMEs. After the invoice is paid in full, the transfer of items will take place and the legal entity change be completed in REACH-IT. If the invoice is not paid within the extended due date the legal entity change is deleted from the system and items will not be transferred. Information about the fee regulation can be found here.

For more information, see the guide How to report changes in identity under REACH and CLP.

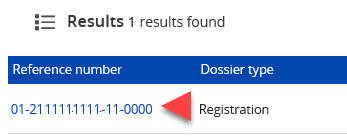

When a legal entity change (LEC) takes place, a new submission number is created to keep track of the asset transfer. These submission numbers are assigned for administrative purposes and are not linked to a dossier.

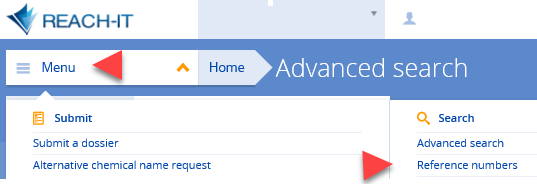

1. Go to REACH-IT Menu > select ‘Reference numbers’

2. Select the reference number linked to the dossier you wish to download

3. Scroll to the middle/bottom of the page, and open the tab ‘Reference number history’

4. Select the last successful submission number (initial submission or submission update in the Event column) that took place before the legal entity change.

5. Click on request IUCLID file

Yes, according to Article 12 of the Fee Regulation (EC) No 340/2008 and the references therein to the definitions concerning micro, small and medium-sized enterprises as set out in the Annex to the European Commission Recommendation 2003/361/EC, both EEA and non-EEA companies are to be considered for the classification of partner and linked enterprises during the determination of the SME status of a company. Moreover, the non-EEA company is the very entity under consideration, in case when a submission is made by an Only Representative, as specified in Article 12 of the Fee Regulation.

Under REACH, registrants and applicants can benefit from reduced fees established for micro, small and medium enterprises (SMEs).

Companies declare their SME size at the time of dossier submission, based on which ECHA issues an invoice. At a later stage, ECHA carries out an ex-post assessment, to verify the correctness of the company size. The SME verification process is important to ensure that only genuine SMEs benefit from the reduced fees and that correct fees are collected.

Before declaring the SME status in REACH-IT, companies should be familiar with the rules set by the Commission Recommendation 2003/361/EC on SME definition.

Companies should upload documentary evidence to their REACH-IT account to support SME status claims. This is only required for those submissions, which are related to SME fee reductions.

The documentary evidence should include:

- Information about the ownership structure (upstream, downstream) at the time of the submission.

- The financial statements (consolidated, if available) together with accompanying notes for the two latest accounting periods before the time of the submission.

- Official certificate/information confirming the average number of employees for each of the two latest accounting periods before the time of submission.

The documents listed above shall be provided for all partner and linked enterprises, as defined by Article 3 of the aforementioned Commission Recommendation.

In case of Only Representatives, the assessment on whether the SME reduction applies is done by reference to the headcount, turnover and balance sheet information of the non-EU company represented and its linked and partner enterprises.

All documents uploaded to REACH-IT are treated confidentially by ECHA and used exclusively for size verification purposes. For transparency and traceability reasons, documents cannot be deleted. It is, however, possible to add supplementary documentation to your REACH-IT account at a later stage. The documentation is not assessed immediately, but only once the size verification process has been initiated.

The list of documentary evidence accepted by ECHA can be found in SME verification -page.

Instructions on how to upload documents and other useful information about REACH-IT can be found at Discover REACH-IT -guide.

More information on company’s size assessment and links to the relevant legislation can be found at SME fees under REACH and CLP -page

If the original version of any document is not in one of the official languages of the European Union, a certified translation should be provided.

Legal basis for certified translations is Article 13(3) of the amended Regulation (EC) No 340/2008 on the fees and charges payable to the European Chemicals Agency pursuant to Regulation (EC) No 1907/2006 of the European Parliament and of the Council on the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH). Please see it at:

http://eurlex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2013:079:0007:0018:EN:PDF

A certified translation is the one which is accompanied by a signed statement that the translator is competent in the source and target languages (a sworn translator) and that the translation is an exact and accurate translation of the source document. The certified translator should have a certificate or a stamp that identifies the services provider and his qualification.

The SME verification process relates to your information obligations at the time of submitting your registration, which includes the obligation to inform ECHA about the eligibility for a fee reduction in accordance with Article 13(1) of Regulation (EC) No 340/2008. Ceasing to manufacture or import of substances have no consequence on that obligation.

If after registering a substance, you have decided to stop manufacturing or importing it, you should still pay the applicable registration fee in full in case ECHA found that you were not eligible for the claimed SME fee reductions. Once the registration fee is paid and, therefore, your registration can be considered complete, you can indicate in REACH-IT that you have ceased the production or import of a substance. If at a later stage you decide to restart manufacturing or importing it, you would only need to report it again in REACH-IT and the registration would still be valid. Otherwise, you would need to submit a new registration and pay a new registration fee.

In case the balance to the correct registration fee is not paid, such registration will be de-activated in ECHA’s database and the rejection of the registration will be communicated to you by a decision.

The SME verification process relates to your information obligations at the time of submitting your registration, which includes the obligation to inform ECHA about the eligibility for a fee reduction in accordance with Article 13(1) of Regulation (EC) No 340/2008. The termination of the OR agreement has no consequence on that obligation.

Since your represented company benefited from reduced SME fee at the time of registration, therefore you, as the appointed OR at that time, are still liable to demonstrate the eligibility for the SME fee reduction obtained, once ECHA initiates the verification of your represented company size. The failure to provide complete documentation would result in ECHA finding your represented enterprise as non-eligible for the claimed SME fee reductions. In such case, the OR would be liable for the difference between the fee already paid and the correct registration fee, as well as the applicable administrative charge.